does instacart take out taxes for employees

If you can find batches with good tips the pay is nice and very flexible hours. Please search your inbox for an email titled Confirm your tax information with Instacart Instacart does not have your most.

Why Do Uber Lyft Doordash And Instacart Want To Classify Their Drivers As Independent Contractors Rather Than Employees Quora

Everybody who makes income in the US.

. What that ultimately means is your actual self employment tax is 1413 of. No its a 1099. If you make more than 600 per tax year theyll send you a 1099-MISC tax form.

Indeed if your earnings in Instacart is above 600 per tax year you will receive a 1099-MISC tax form. Instacart will file your 1099 tax form with the IRS and relevant. Yes - in the US everyone who makes income pays taxes.

Fees vary for one-hour deliveries club store deliveries and deliveries under 35. You can even write-off from your taxes the cost of hiring a tax professional if needed - this is optional if you seek out tax advice but highly recommended. Instacart delivery starts at 399 for same-day orders 35 or more.

If you are looking for a hands-off. For its full-service shoppers Instacart doesnt take out taxes from paychecks. For tax purposes theyll be treated the same as anyone working a traditional 9-to-5.

Instacart does not take out taxes for independent contractors. Instead full-service shoppers are considered contract workers and they must file a 1099 form with the IRS during. There is a 45 late.

Does Instacart take out taxes for its employees. The email may be in your spamjunk mail folder. To make saving for taxes easier consider saving 25 to 30 of every.

Answered May 15 2019 -. Up to 5 cash back Order same-day delivery or pickup from more than 300 retailers and grocers. If you work as an in-store shopper you can stop reading this article right here.

Does Instacart Take Out Taxes For All Employees. As an independent contractor you must pay taxes on your Instacart earnings. Employees have taxes taken out.

Does Instacart take out taxes for its employees. This is a standard tax form for contract workers. Depending on your location the delivery or service fee that you pay to Instacart in exchange for its service may.

This can make for a nasty surprise when tax time rolls around as youre responsible for paying the necessary state and federal income taxes on the money you make. Instacart will take care of withholding for them and send them a form W-2 at tax time. Because Instacart shoppers are contractors the company will not take taxes out of your paycheck.

As youre liable for paying the essential state and government income taxes on the cash you make. No minimums to stay working and I sometimes had to go on hiatus. Report Inappropriate Content.

There will be a clear indication. I worked for Instacart for 5 months in 2017. The 1413 is the amount youll have to pay in self employment tax.

In-store shoppers are classified as Instacart employees. Instacart shoppers are required to file a tax return and pay taxes if they make over 400 in a year. As an independent contractor you must pay taxes on your Instacart earnings.

For gig workers like Instacart shoppers they are required to file a tax return and pay taxes if they make over 400 in a year. This form works for all. The exception is if you accepted an employee position.

Do not receive a w2 from Instacart. Instacart does not accept cash and unfortunately there arent. Download the Instacart app or start shopping online now with Instacart to get.

Does Instacart take out taxes. Taxes for full-service shoppers. Does Instacart take out taxes for its employees.

Stride Tip If you ever owe more taxes than you can afford and youre not able to pay your entire owed tax on time make sure to file your tax return anyway. 153 of that 9235 is 1413. The estimated rate accounts for Fed payroll and income taxes.

Answered June 5 2019 - Personal Shopper Current Employee - Phoenix AZ. I got my 1099 and I have tracked all my mileage and gas purchases but what else do I need to do. This can make for a frightful astonishment when duty time moves around.

This includes self-employment taxes and income taxes. If you cannot find any good. Has to pay taxes.

Instacart usually wont take out taxes since youre an independent contractor and have to pay estimated taxes. The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15. Your total yearly take-home.

The first is the additional employer share of payroll taxes which are paid by independent contractors but not employees which works out to 765 of pay.

How To Fill Out Schedule C Grubhub Doordash Uber Eats Instacart Instacart Rideshare Grubhub

How To Claim Expenses As An Employee

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Covid 19 Communications Pusateri S

I Work Instacart And Aldi I Decided To See What They Had To Say About Shoppers And I M Not Surprised Lol R Instacart

When Does Instacart Pay Me A Contracted Employee S Guide

What Is A Gst Hst Number Canada Only Instacart Onboarding

Home Office Deductions For Self Employed And Employed Taxpayers 2022 Turbotax Canada Tips

This Post Will Walk Through The Fourth Report In Bluegranite S Power Bi Showcase A Series Desig Employee Retention Data Visualization Machine Learning Models

Is Instacart Considered Self Employment It Depends Grocery Store Tips

Instacart Is Not Honoring States Minimum Wages Virginia S Minimum Wage Raised Till 11 Dollars Today And Instacart Says We Need To Pass A Law To Change This For Our States Workers

I Work Instacart And Aldi I Decided To See What They Had To Say About Shoppers And I M Not Surprised Lol R Instacart

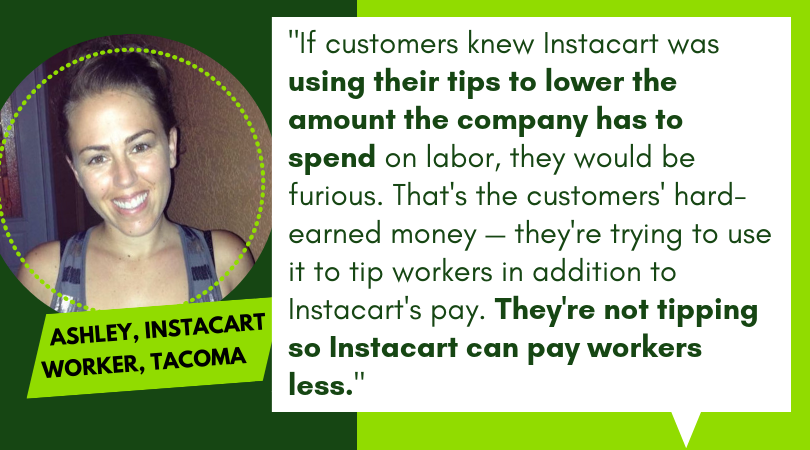

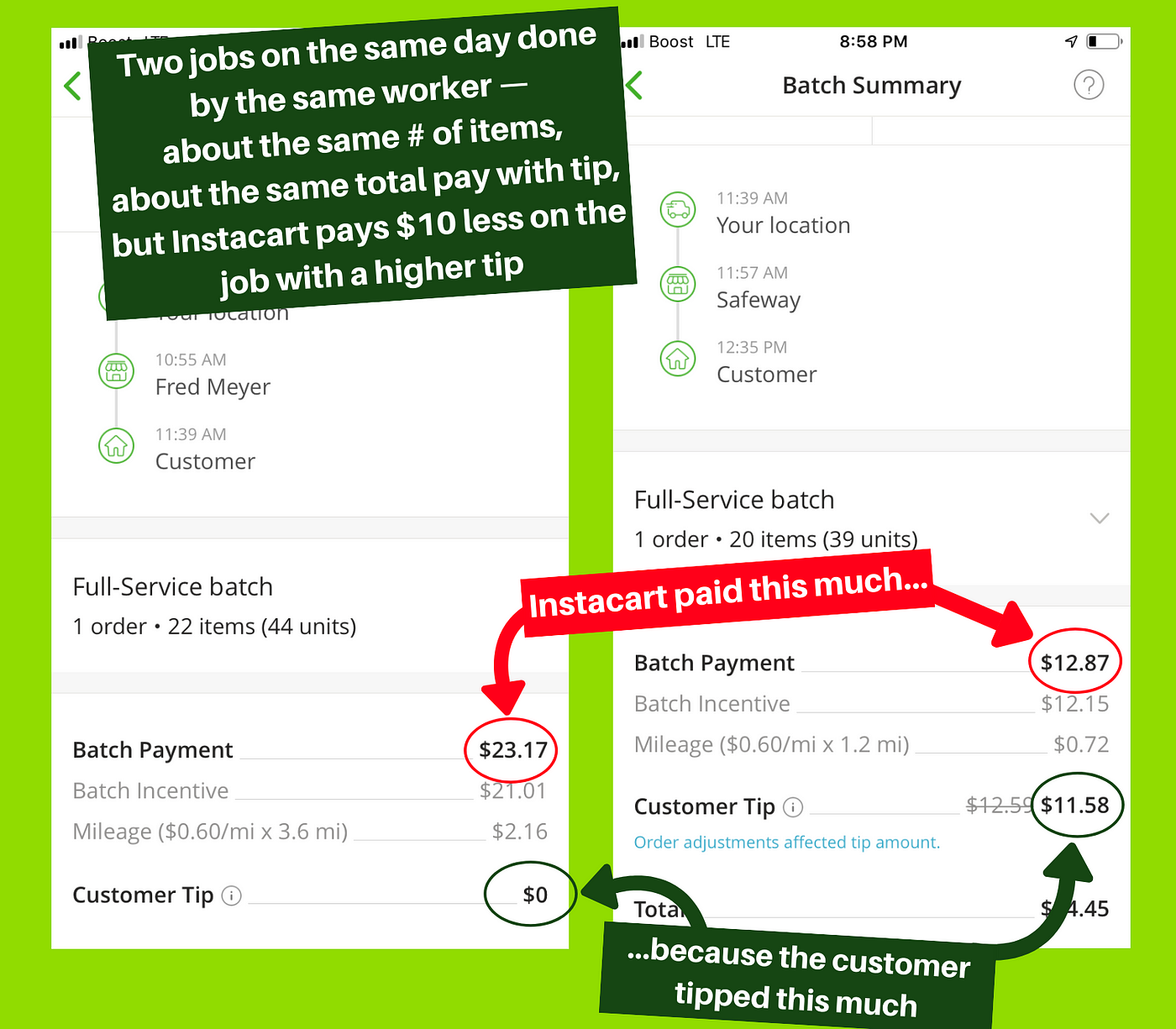

Instacart S Transparent New Pay Structure Underpayment Tip Theft And Black Box Algorithms Working Washington

Instacart Here S Our 22 Cents No More Tip Theft Low Pay And Black Box Pay Algorithms By Working Washington Medium

What You Need To Know About Instacart Taxes Net Pay Advance

Why Are Instacart Workers Calling On Costco For Support Payup

Instacart Here S Our 22 Cents No More Tip Theft Low Pay And Black Box Pay Algorithms Coworker Org

Intuit Quickbooks Desktop Pro With Payroll 2021 English Version Costco